Requirements for Leasing a Commercial Space

Leasing a

commercial space can feel a bit like starting a relationship. There’s the initial excitement, followed by a deep dive into whether it’s the right fit, and finally, navigating the long-term commitment. Much like that easy-going friend who always has your back, a great commercial space can be a game changer for your business. But, like any solid partnership, it comes with its own set of rules and requirements. So, is your potential lease a simple arrangement, or is there more under the surface? Let’s find out…

The Space: Your Business’s New Best Friend

Finances: The Trust Factor

Every strong relationship is built on trust, and leasing a commercial space is no different. To win over your future landlord, you need to show them you're financially solid. They’ll likely want to see your business’s credit score and review your financial statements, like how you might check a friend’s reliability before lending them your favorite book.

Your creditworthiness, profit and loss statements, and even your business’s formation documents help establish that trust. Landlords want to know you’re in it for the long haul and can meet the financial demands that come with running a business. So think of it as showing your true colors—honesty and transparency are your best allies here.

Lease Terms: Defining the Relationship

Now that you’ve found your match, it’s time to define the relationship. A

commercial lease is more than just a piece of paper—it’s an agreement that outlines the expectations of both parties. Just like you wouldn’t enter into a friendship without understanding the boundaries, you shouldn't sign a lease without fully grasping the terms.

What are your responsibilities versus your landlord’s? Will you be responsible for keeping the space spick-and-span, or does that fall under the landlord’s care? What about repairs and upgrades—who foots the bill if something breaks down? These are the kinds of details that make or break the relationship between you and your space.

In Texas, there is no "standard" lease for commercial properties.

Lease terms are generally negotiated between the landlord and the tenant, which allows for a lot of flexibility. Both parties are free to create agreements that suit their needs, but this also means careful review is crucial before signing.

Rent Increases and Escalation Clauses

Upfront Costs: The Price of Admission

Leasing a space is a bit like prepping for a big night out—you’ve got to budget for more than just the main event. Sure, the monthly rent is the headliner, but let’s not forget the supporting acts. First up: the security deposit. Think of it as the cover charge, a little extra upfront to reassure the landlord that you’ll treat their space with care. Depending on the terms, you might also be asked to pay the first and last month’s rent—kind of like prepaying for that Uber ride home before the party even starts.

But what if the space you’re leasing doesn’t quite fit your vibe from the get-go? Much like tailoring an outfit for that perfect fit, there may be renovation or build-out costs to factor in. Whether you need to knock down a wall, add some custom features, or simply give the place a fresh coat of paint, these are the investments that help make the space truly yours. It's all part of making sure the relationship with your new space kicks off on the right foot—comfortable, functional, and perfectly suited to your business style.

Improvements and Build-Outs

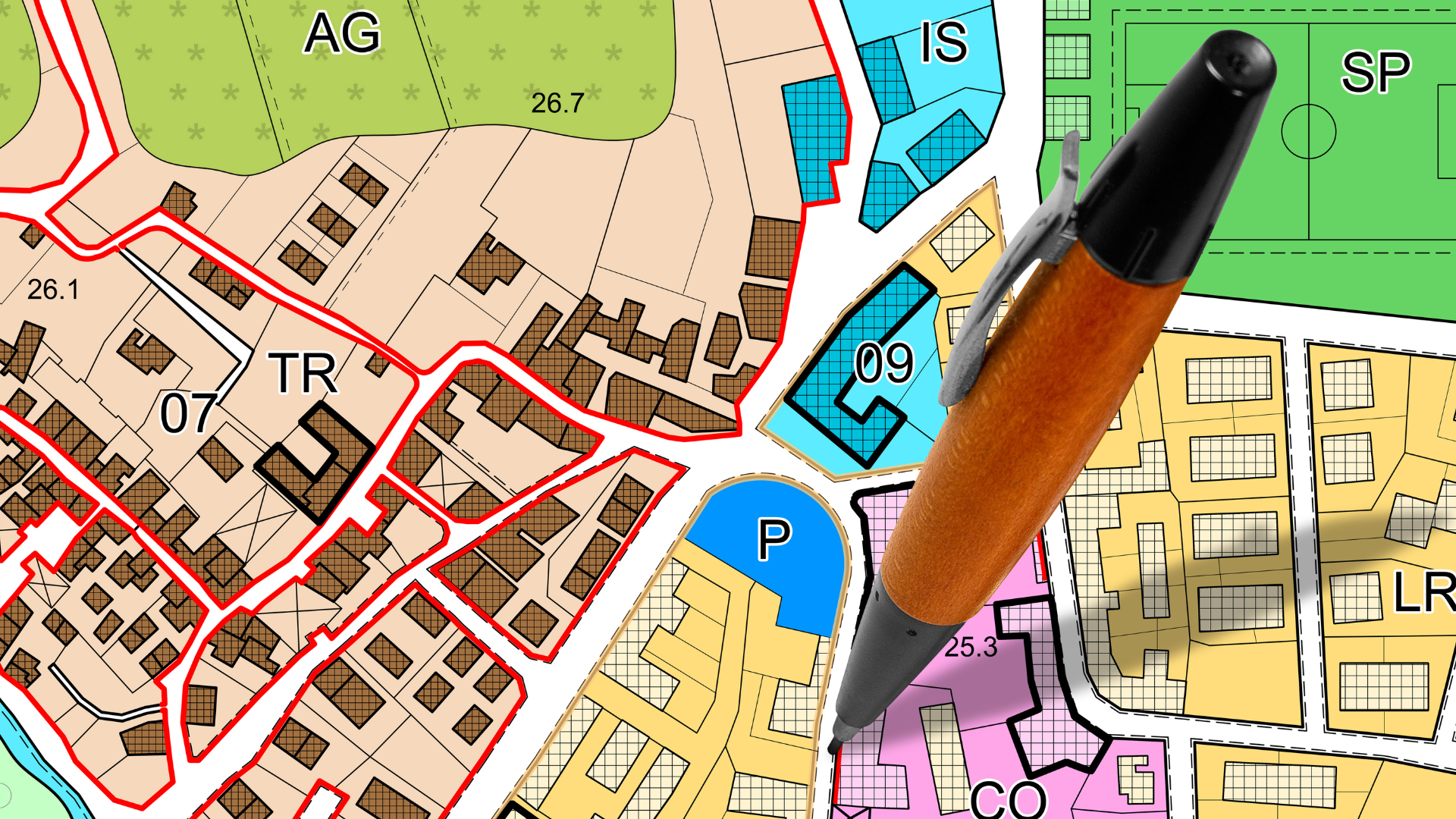

Zoning Laws: Staying Within the Lines

Negotiation: Finding the Balance

Every relationship requires a little give-and-take, and negotiating a lease is no different. At CIP Texas, we believe in making sure you get a deal that works for your business. A commercial lease can be as flexible or as rigid as you make it—whether you're discussing rent increases over time, who handles property maintenance, or your right to renew the lease at the end of the term, it's all part of finding that perfect balance.

Think of it like sitting down with a good friend to hash things out—you want to walk away with both sides feeling good about the agreement. So take your time and don’t be afraid to ask for terms that will set your business up for success.

Legal Review: Avoiding Misunderstandings

Before signing anything, it’s always a good idea to have a third party—like a lawyer—take a look. Just as you wouldn’t jump into a partnership without some careful thought, you shouldn't enter into a lease without knowing exactly what you’re agreeing to. A quick review can help avoid any legal misunderstandings down the road, ensuring that both you and your space are on the same page from day one.

Planning for the Future: Growing Together

Just like a long-lasting friendship, you want a lease that allows room for growth. Whether that means renewing your lease under favorable conditions or expanding into an adjacent space, it’s important to think about the long term. Does the lease offer flexibility if your business grows? Can you move to a bigger space in the same building or add on square footage as needed?

A good commercial lease can grow with your business, offering the support you need as your company evolves. At CIP, we work with clients to ensure they have the flexibility to scale up when the time comes.

Final Thoughts: More Than Just a Lease

Leasing a commercial space isn’t just a transaction—it’s the start of a meaningful relationship between your business and its new home. Much like a friend who helps you through thick and thin, the right space can be a steadfast partner, helping your business thrive.

At CIP, we’re here to guide you through the process, ensuring you find the perfect space and lease terms that align with your business goals. So, whether you’re a growing startup or an established business looking for a new headquarters,

let us help you find the space that will be your business’s new best friend.