Capitalization Rate in Real Estate

If you’re diving into commercial real estate investment, you’ve probably heard about

capitalization rates, or cap rates for short. This simple formula is one of the most useful tools for evaluating a property’s performance and comparing different opportunities.

As an Austin-based brokerage specializing in

commercial, industrial, retail, and land properties, we work with investors every day to help them make sense of cap rates and what they mean for their portfolios. So, let’s break it down in a straightforward, no-nonsense way.

What’s a Cap Rate, Anyway?

Think of the capitalization rate as a quick way to gauge a property’s return on investment (ROI). It’s the percentage you’d earn annually if you paid cash for the property.

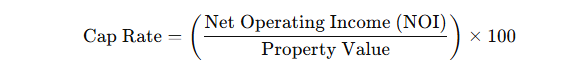

The formula is pretty simple:

- Property Value: What the property is worth or the price you paid for it.

For example, if a property generates $100,000 in NOI and costs $1,000,000, the cap rate is 10%.

Why Cap Rates Matter in Austin Real Estate

As of December 7, 2024, the average cap rate in Austin is approximately 5.57%

How Capitalization Rates Vary by Property Type

Different types of properties in Austin come with different rates. Here’s a snapshot:

- Commercial Office Spaces:

- Downtown Austin: Lower cap rates (4–6%) because of the high demand.

- Suburban offices: Slightly higher (6–8%) but still solid investments.

- Industrial Properties:

- Austin’s logistics and warehouse spaces are hot right now, with cap rates between

5–7%.

- Retail Spaces:

- Retail properties in growing neighborhoods usually fall in the

6–8% range. Prime locations, like near major tech campuses, tend to be on the lower end.

- Land Investments:

- Land can have higher cap rates (7–10%) since there’s more risk and longer development timelines involved.

What Affects Cap Rates?

Capitalization rates in real estate aren’t just about math—they’re influenced by a lot of factors, like:

Using Rates the Smart Way

Here’s the deal: Cap rates are helpful, but

they’re not the whole story. We always tell our clients to use them as part of a bigger picture.

- Compare Like Properties: Look at similar

properties in similar locations.

- Study the Trends: Is the neighborhood growing? Are cap rates shifting?

- Think Long-Term: Lower rates often mean the property is more stable and likely to appreciate over time

Austin vs. Other Texas Cities

Austin’s cap rates are generally lower compared to other Texas cities, which reflects the high demand here. For example:

- San Antonio: Offers higher cap rates for industrial and retail properties—less competitive than Austin.

- Houston: More volatile cap rates tied to the ups and downs of the energy industry.

How We Help Investors Make Sense of Cap Rates

The Bottom Line on Capitalization Rates in Real Estate

Cap rates are one of the most important tools in real estate investing, especially in a booming market like Austin. They help you figure out the balance between risk and reward, so you can make smarter decisions.

If you’re ready to explore commercial real estate in Austin—or just want to learn more—our team is here to help. Let’s find the investment that’s right for you.

Want to dive deeper?

Contact us today, and we’ll guide you through the ins and outs of Austin’s real estate market.